Investors on War Footing for Europe Crisis After Crash

Investors On War Footing for Europe Crisis After Market Crash

(Bloomberg) -- European Central Bank President Mario Draghi’s pledge in 2012 to do “whatever it takes” to save the continent in the midst of the crisis helped bring bond markets back from the brink. Now, Christine Lagarde may be pushing them back there.

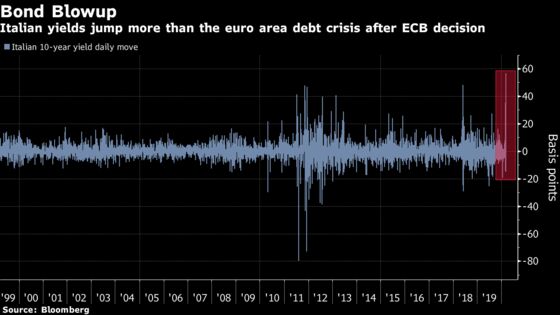

Italian bonds steadied on Friday after enduring their worst day ever -- trumping other momentous times in history, including the euro-area debt crisis and 2018’s budget standoff with the European Union. Trading in the country’s bond futures and those of France had to be halted after seeing a flash crash-like slide.

The icing on the cake of superlatives came with European stocks suffering their worst session on record.

“Carnage,” said Joubeen Hurren, a money manager at Aviva Global Investors, in describing the monumental bond moves in the wake of the ECB. “Markets here are beginning to price the worst-case scenario.”

“We are not here to close spreads,” Lagarde said during her press conference in the wake of the ECB keeping interest rates on hold and announcing 120 billion euros ($134 billion) extra of quantitative easing, in a move that fell short of recent efforts by the Bank of England and the Federal Reserve. “This is not the function or the mission of the ECB.”

Investors took heed, selling Italian, Spanish and Portuguese bonds in droves on Thursday as liquidity deserted the market. Italy’s yield spread over Germany tightened slightly on Friday after it hit the highest level since June last year. Others snapped up disaster hedges, buying short-dated German bonds versus interest-rate swaps.

Lagarde backpedaled a bit in a later interview with CNBC, saying that the ECB is mindful of fragmentation risks and its tools will be completely available to Italy. But the message for investors was clear -- the ECB is virtually out of ammunition should the bloc enter a euro crisis once again.

This time the coronavirus is to blame, closing factories and schools across the continent, while the whole of Italy is in lockdown. A recession is now likely.

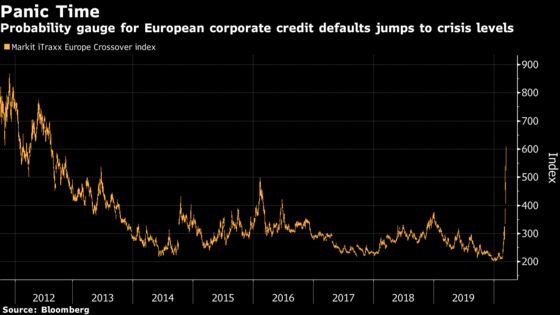

The Markit iTraxx Europe Crossover index, a gauge of European corporate default swaps, soared above the psychologically-important 600 level, implying a 38% default probability in European corporates. Such a level hasn’t been seen since 2012 -- the height of the euro-area debt crisis -- when the yield on an Italian 10-year bond was at 7% and those on Greek securities at nearly 45%.

The euro and the pound steadied on Friday after slumping as demand for dollars surged. The Fed and BOE showed that they still have some weapons left in their arsenals by cutting interest rates by 50 basis points this month in emergency moves.

Time for Action

Investors want to see more action and political leadership as infections spread. The leading U.S. infectious-disease official said Thursday the testing system in the country is failing, while President Donald Trump’s travel restrictions have drawn criticism from EU leaders.

For some in the market, Thursday’s sell-off was a clear sign that the EU hasn’t done enough to integrate the fiscal capabilities of the bloc to the same extent as the monetary union since the last crisis a decade ago.

“The ECB is on the edge of exhaustion,” said Oliver Blackbourn, a multi-asset portfolio manager at Janus Henderson Investors. “There have been concerns about the fractured nature of power within the euro zone since 2011 and it is crisis situations like this that investors have feared.”

The U.K. was able to draw on a fiscal stimulus package Wednesday, involving plans for the biggest sale of bonds in nearly a decade. And that was without accounting for short-term coronavirus spending measures.

However, the ECB at the moment has no luxury extras at hand. Germany gave its strongest hint yet that it could abandon its commitment to a balanced budget, but the market is still awaiting details. Bund yields are still hovering near record lows.

Investors are now looking at a broader horizon for some sort of unified approach. “We’re in a corona crisis,” said Kit Juckes, a strategist at Societe Generale SA, in London. “Markets want more than the ECB can do on its own.”

(An earlier version of this story corrected the date of Draghi’s pledge in first paragraph.)

--With assistance from Carolynn Look and Paul Gordon.

To contact the reporter on this story: John Ainger in Brussels at jainger@bloomberg.net

To contact the editors responsible for this story: Dana El Baltaji at delbaltaji@bloomberg.net, Pete Norman, Neil Chatterjee

©2020 Bloomberg L.P.